Have you ever imported goods and received the charge for duty and/or VAT and wondered where those figures have come from? Or maybe you use customs declarations software and see the charges that are raised and wondered the same?

If you have experience in customs, you will probably know how duty and VAT is calculated, however there are many who don’t. Calculating duty and VAT can be a confusing task, especially when you consider the things that affect it – additions, deductions, different commodity codes amongst others.

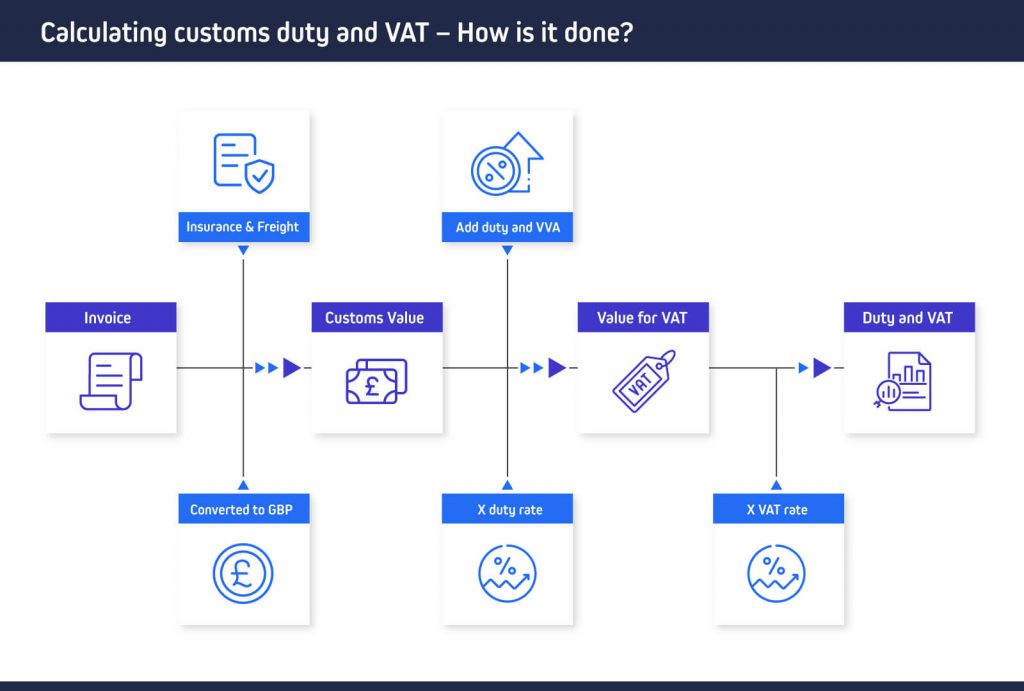

To get an idea of how it works, lets first look at the diagram below.

So, to calculate the duty we need to get the customs value for duty and to get the VAT we need the value for VAT, but how do we get there?

In this example, the customs value includes:

• the invoice,

• the insurance,

• and the freight amounts of getting the goods to the UK.

Working out the duty:

We then take the customs value and times that by the duty amount which gives the amount of duty that will be paid.

Working out the VAT:

To then get the value for VAT, we are going to add the customs value, the duty and the VAT Value Adjustment (VVA). We then multiply this by the VAT rate to give us the amount that will be charged.

Let’s take what has been said above and go through an example to show this. Below are the figures that we will work with:

• Invoice £10,000.00

• Freight £100.00

• Insurance £50.00

• Duty rate 10%

• VVA £500.00

Working out the custom value:

To get the customs value for duty, we need the invoice, the freight and the insurance amounts added together:

£10,000.00

+ £100.00

+ £50.00

= £10,150.00 (customs value)

The customs value is then multiplied by the duty rate:

£10,150.00 x 10% = £1015.00 (amount of duty due)

To get the value for VAT we need the customs value, the duty amount and the VVA added together:

£10,150.00 + £1015.00 + £500.00

= £11,665.00 (value for VAT)

Finally, we times that by the VAT rate (in this instance 20%) to get our payment amount:

£11,665.00 x 20%

= £2,333.00

Total duty payable – £1015.00

Total VAT payable – £2,333.00

The above is a simple calculation however there are a lot more scenarios that can affect how much duty and/or VAT payable.

Just to name a few, these can be things like:

• Different tax types

• Additions i.e., sales commission / Deductions i.e., discounts

• Importing different items

Contact us on 01942 202202 for help and advice, or visit: langdonsystems.com/consultancy for more information.

Johnny Evans – Customs Consultant